The German Mittelstand in Globalia

Globalia is what I call the globalized world of the future. What will Globalia look like in 2030? We will see a two-split world with the US leading in terms of GDP, closely followed by China and the EU. China will contribute the biggest growth, whereas all other individual countries will have much smaller economies and less GDP growth.

On a global scale there are few saturated markets. Globalia holds practically unlimited growth potentials for companies worldwide, especially for international trade. Global per capita exports were close to zero in 1900, and rose to $437 in 1980. In the following 20 years global per capita exports more than doubled, since 2000 they again almost tripled to $2,904 in 2015. This “explosion” has taken place in spite of a rapidly growing global population.

In 1900 the world’s population was 1.6 billion, today we are 7.3 billion. In absolute terms global exports today are about 2.000 times larger than in 1900. Global trade will most likely continue to grow faster than national GDPs. Each company participating in this accelerating globalization can profit enormously. How do individual countries fare in Globalia? Comparing the per capita exports for a selected group of large countries over a ten-year period (2006–2015), the differences are striking.

Germany is an extreme outlier with double the per capita exports ($166,475) of other large European countries such as France ($83,606). China ($12,637) and India ($1,888) still have very low per capita exports, which I interpret as an indicator for huge growth potentials. What makes certain countries strong in exports? Can the current export weakness of a country be interpreted as a potential to increase exports, generate growth and create jobs? Can exports become a growth area for emerging countries with low per capita exports, such as India and other Asian countries? The case of China certainly suggests this.

Export performance and company size

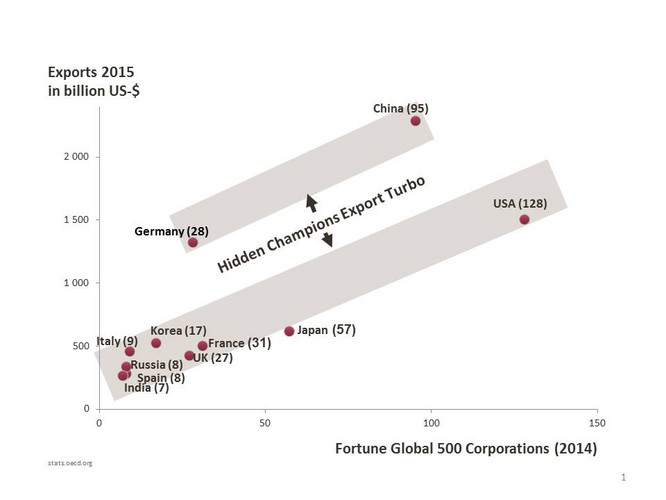

Most people assume that export performance depends on the prevalence of large corporations. Is there also a role of small and mid-sized companies in exports? Whilst for most countries there is indeed a strong correlation between the number of large firms and exports, there are two exceptions, China and Germany. Exactly these two outliers are the leading export nations. What distinguishes them from other countries? It is the share of exports contributed by mid-sized firms. 68% of Chinese exports come from companies with less than 2.000 employees. In Germany the Mittelstand contributes about 70% to exports.

Global trade grows faster

This suggests that in order to achieve exceptional export performance a country needs both large corporations and a broad foundation of small and mid-sized exporters. For most emerging countries it seems a vain hope to develop a significant number of Fortune Global 500 firms. In the 1980s Malaysia set out to become a force in the global auto market and founded a company called Proton. Although this car manufacturer started with high ambitions, Proton has remained a regional competitor with negligible global weight.

Another Malaysian company, Top Glove, has become the world’s market leader for rubber gloves by taking advantage of the country’s natural rubber resources. Emerging co untries seem well advised to build their economic future primarily on small and mid-sized firms. This will allow them to get a fairer share of the growing global economy. Modern global communication and transport infrastructures enable small and mid-sized firms to do business on a worldwide scale.

What are Hidden Champions?

A Hidden Champion is a company which is one of the top three in its global market, has less than $5 billion in revenue, and is little known in the public. A revenue of $5 billion may seem large, but it is less than one fourth of the revenue of the smallest Fortune Global 500 company. The explanation of Germany’s export success lies in its Hidden Champions. With a number of 1,307 in total, Germany has more mid-sized world market leaders than any other country, followed by the USA with 366 and Japan with 220. But there are Hidden Champions all over the world. My experience is that their cultures and strategies are remarkably similar.

The strategies of Hidden Champions

The key question is: What can companies and politicians learn from the Hidden Champions? What are they doing differently from large corporations? The answer: Almost everything! I will present seven lessons which can benefit both large and small companies, especially in emerging countries.

1. Very ambitious targets

The Hidden Champions set very ambitious goals related to market leadership and growth. The goal of Chemetall is “the worldwide technology and marketing leadership“. Chemetall is a global leader in special metals such as cesium. 3B Scientific, a small company and world leader in anatomical teaching aids, aims ”to become and stay number 1 in the world“. But leadership goes further, as is expressed by Sick, a global leader in sensor technology: “We lead by anticipating our customers’ expectations. Leadership means becoming the benchmark for others.” Rosen Group, the global leader in pipeline inspection systems, states: “We want to create ultimate value for our customers as the world’s undisputed leading supplier. It is our objective to be the world’s most competitive provider.

Lesson 1: Success always begins with ambitious goals. The Hidden Champions go for growth and market leadership. This is the fuel that drives them forward.

2. Focus and depth

“We always had one customer and will only have one customer in the future: the pharmaceutical industry. We only do one thing, but we do it right”, says Uhlmann, the world leader in packaging systems for the pharmaceutical industry. Closely connected to focus is a deep value chain. An example is Wanzl, world leader in shopping and airport baggage carts: “We produce all parts by ourselves, based on the quality standards we define.” The fact that carts at airports all over the world are made by Wanzl shows that airport operators are willing to pay high prices for superior quality.

Most Asian airports have carts from Wanzl. Since they make everything by them - selves Wanzl has total quality control. To achieve superiority in the end product, the Hidden Champions entrench several steps deeper in the value chain to create unique processes, technologies and components. Uniqueness and superiority can only be created internally. The Hidden Champions are extremely hesitant to outsource core competencies.

Lesson 2: Only focus and depth lead to world class. The Hidden Champions focus on narrow markets and are deep rather than broad. They tend to do most things by themselves.

3. Globalization

Focus makes a market small. But how do Hidden Champions manage to extend the market? By globalizing! They combine their specialization in product and know-how with global selling and marketing. As discussed, there are hardly any growth limits if you go out to Globalia. But customers are not coming to you. Kärcher, the global leader in high pressure water cleaners, took its first steps towards globalization in the 70s and has 100 subsidiaries in 60 countries today.

But to reach its goal of being present in all 206 countries of the world, Kärcher still must enter more than 100 markets. Similarly to Kärcher, the Hidden Champions globalize by establishing own subsidiaries in all important markets around the globe. They build direct customer relationships instead of delegating their customer relations to intermediaries, agents or importers.

Lesson 3: Hidden Champions combine specialization in product and know-how with global selling and marketing. Globalization is the growth booster for them. They serve the target markets through their own subsidiaries and heavily invest into future markets.

4. Innovation

One does not become world market leader by imitation, but by innovation. Innovation starts with research and development. R&D spending of the Hidden Champions is twice as high as in an average industrial company. Even more important is the output. Hidden Champions have five times the number of patents per thousand employees than large corporations (31 vs. 6 patents). And one Hidden Champion patent costs only one-fifth of the patent of a large corporation. What is the driving force of innovation? Market, technology or both? 65% of the Hidden Champions consider these two forces as well-integrated whereas only 19% of the large companies do so.

Lesson 4: The Hidden Champions are in a phase of massive innovation. The effectiveness of their R&D activities beats that of large companies by a factor of 5. Their innovations are both market- and technology-driven.

5. Closeness-to-customer and competitive advantages

The biggest strength of the Hidden Champions is, however, not technology but closeness-to-customer. This is a natural advantage of smaller and midsized companies. An average of 38% of their employees have regular customer contact compared to only 8% in large corporations. The strategies of the Hidden Champions are value-driven, not price-driven. They usually command a price premium of 10 to 15% over the average market price, which shows how price and value are related. Another outstanding competitive advantage of the Hidden Champions is product quality.

Lesson 5: Closeness to customer is the greatest strength of the Hidden Champions. Their strategies are valueoriented, not price-oriented. They hold strong competitive positions.

6. Loyalty and highly-qualified employees

The Hidden Champions have “more work than heads”, highly qualified employees and low turnover. They invest 50% more into vocational training than the average German company. The share of university graduates has more than doubled, from 8.5% of the workforce ten years ago to roughly 20% today. Competitiveness in Globalia is more and more about qualification. The Hidden Champions have extremely low turnover rates: only 2.7% annually as compared to the average for Germany of 7.3%.

Lesson 6: Hidden Champions have “more work than heads” and high performance cultures. Employee qualification is top. Turnover and sickness rates are extremely low.

"more work than heads"

7. Strong leadership

The ultimate explanation for the unusual success of the Hidden Champions lies in their leaders. They are characterized by a very strong identity of person and mission. Their leadership is ambivalent. There is no discussion regarding the company’s principles and values, but the employees enjoy great latitude and flexibility in the details of carrying out a job. The Hidden Champions have more women in top positions and very high continuity of the CEOs. The average CEO tenure is 20 years.

Lesson 7: The secret of the Hidden Champions’ success lies in their leaders. They are characterized by total identification with their mission. Their leadership is authoritarian in the principles, but flexible in the details. Continuity is very high. Young CEOs and women play a more important role than in large companies.

Résumé of the key lessons

The core is a strong leadership with ambitious goals. The inner strengths are depth, high performance employees, and continuous innovation. The outer circle comprises focus on a narrow market, closeness-to-customer, clear competitive advantages, and all that with a global orientation. Hidden Champions go their own ways towards Globalia, more decisively and successfully than ever. They do most things differently from the teachings of modern management fads. They are role models of strategy and leadership in Globalia.

Lessons for emerging countries

Emerging countries would be well advised to pin their hopes on numerous internationally competitive mid-sized companies rather than on a few giant corporations. The Hidden Champions can be strategic role models for these countries. There are Hidden Champions from emerging countries which have even beaten former market leaders from Germany. In 2009, the Chinese construction machinery maker Sany took over Putzmeister from Germany as the global leader in concrete pumps. In 2012, it acquired Putzmeister.

In what sectors are the chances of Hidden Champions from emerging countries most promising? The clear answer: In sectors where the country has competitive advantages. Often these are natural resources, such as citrus fruits in the case of Brazil or jute in Bangladesh. But advantages can also result from traditions and skills. Emerging countries and their companies should not limit themselves to producing and exporting primary goods.

Rather they should process these goods and sell the semi-finished or finished products at higher prices. Hidden Champions like Cutrale in Brazil and Top Glove in Malaysia prove that this is a path towards success. Countries such as Taiwan or Korea have gone through this process and succeeded. Starting very poor not so long ago, they have now attained leading global positions in numerous markets. Individual entrepreneurs in emerging countries can learn from the Hidden Champions. One aspect is specialization. Often successful entrepreneurs in emerging countries are tempted to diversify because of numerous growth opportunities in their home markets.

This pattern applies right up to the highest size category, so that extremely broad-based conglomerates are typical (such as Koc and Sabanci in Turkey or Samsung and Hyundai in Korea). Instead, SMEs should stay focused and concentrate on conquering a leading market position in their country and region, as only focus leads to world class. A very important point is global presence. Most SMEs prefer to sell via distributors and consequently do not have direct customer access.

The Hidden Champions, however, establish their own sales subsidiaries, which bring them closer to customers, help them build customer loyalty and provide them with feedback for innovations. The mental internationalization of employees is critical. In foreign markets you need people who speak the customers’ language. Income inequality is one of the biggest challenges of mankind. Strong small and mid-sized companies are an effective way to create a more even income distribution.

Therefore, all countries should strive to foster a strong mid-sized sector of Hidden Champions.