E-Mobility in China and Japan

The automotive industry has been encountering a fundamental change in recent years with the emergence of electric mobility (e-mobility). Energy security, future export opportunities and limiting emissions are amongst the factors that have driven development in many countries across the world. Two major Asian economies, China and Japan, announced ambitious goals to become leaders in the e-mobility and battery markets.

In China, the development of policies first began at the end of 2008. Three years later, the government in Beijing had already proposed a strategy for the full implementation of electric driving. By 2020, China aims to have 4.6 million electric passenger cars on the road as well as 120,000 fast charging and 500,000 total public stations. In Japan, although e-mobility had been on the agenda before, it wasn’t until 2009 when prime minister Hatoyama promised to cut carbon dioxide emissions that major policy plans were published. Japan aims to increase the share of next-generation vehicles in new vehicle sales to 50- 70% by 2030, of which battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) should account for 20-30% and hybrid electric vehicles (HEVs) for 30-40%. Additional goals are the installation of two million ordinary chargers and 5,000 quick chargers and the achievement of a 50% market share for Japanese companies in the global storage battery market.

Since the announcements of their strategies, China and Japan have promoted the development of e-mobility at different stages of the implementation process. Both countries have launched and funded major R&D projects and cooperated with key players from the car industry, research institutions, and universities. In terms of infrastructure, the governments in Beijing and Tokyo have been active in launching and funding projects in major cities and along major traffic routes. In China, the funding of 88 designated pilot cities was crucial for the expansion of the charging network. To receive funding, cooperating cities were required to provide one charging point for every eighth vehicle, and charging stations were designed to be no farther away than one kilometer from any point within the center area of the city. In Japan, the ‘next generation vehicle charging infrastructure deployment’ was one of the major undertakings to expand the number of charging stations. To get local governments, highway operators and other players to cooperate in this program, charging equipment and up to two-thirds of the installation costs were subsidized by the Japanese government.

Besides funding R&D and expanding the charging infrastructure, another key measure to increase the adoption rate of EVs is the cutting of high purchasing and maintenance costs. Therefore, both governments have provided financial incentives such as purchase grants, tax cuts and exemptions from registration and license fees. In China, for instance, buyers of electric cars were released from the obligation to pay vehicle purchase tax and the vehicle and vessel tax. At the same time, tax rates on traditional passenger cars were raised to make the purchase of conventional cars unappealing. The Japanese government, on the other hand, did not increase taxes on traditional cars. However, it created incentives by reducing or eliminating the vehicle purchase tax, the motor vehicle tax, the tonnage tax, and the mini- vehicle tax. Considering the heavy tax burden for Japanese car owners, a very attractive measure.

A method that has been introduced lately and that is rather unique to China is the dual-credit policy for manufacturers. To obtain so-called ‘energy credits’, manufacturers need to produce a minimum number of EVs, and the number of credits they receive will be based on factors such as driving range and car weight. The policy requires that 10% of a car manufacturer’s total credits must consist of new energy credits in 2019 and 12% in 2020. Manufacturers failing to meet the requirements will be fined or must buy credits from other companies.

As illustrated in table 1,579,000 passenger cars (468,000 BEVs and 111,000 PHEVs) were sold on the Chinese market in 2017. Adding this to the already existing stock, Chinese plug-in electric vehicles (PEVs) accounted for over 1.2 million units, which was 40% of the global fleet, and 2.2% of the domestic car market. In Japan, on the other hand, sales of a mere 54,100 PEVs were registered in 2017. As a result, Japan’s domestic fleet rose to a total number of 205,400 (104,500 BEVs and 100,900 PHEVs). This was 6.6% of the global fleet and 1% of the Japanese car market. While these numbers are comparably low in relation to Chinese levels, Japan clearly outranks China in terms of HEVs. With 1.4 million units in 2017, they accounted for 31% of all domestic new passenger car sales, making Japan the leading producer worldwide.

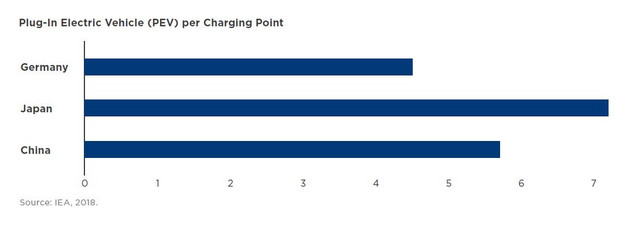

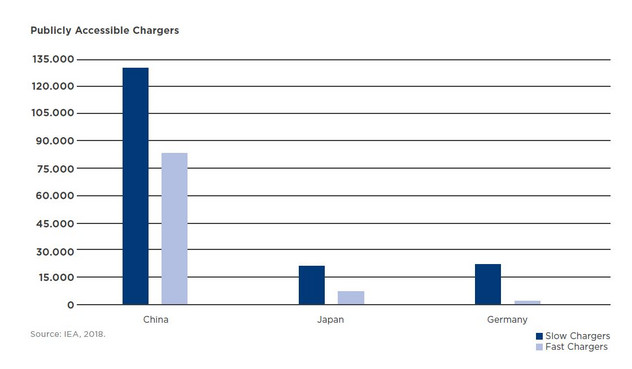

When we look at data for charging infrastructure, we can see that China is not just the largest producer of PEVs, but also the country with the biggest infrastructure network. In 2017, 213,900 charging points (130,500 slow and 83,400 fast charging stations) existed in China, compared to 28,800 charging points (21,500 slow and 7,300 fast charging stations) in Japan. While these numbers suggest that China is far ahead of Japan, when we look at the ratio of cars to charging stations, it becomes apparent that China and Japan are almost on equal terms. In China, one public charging point is provided for roughly six cars, while it is one charge point for every seventh PEV in Japan.

In conclusion, China and Japan have both shown their ambitions to become world leaders in the e-mobility and battery markets by actively employing the concept of e-mobility and providing incentives and funding at all stages of the implementation process. China is the largest market for PEV in the world, accounting for 40% of the global fleet. Yet demand is still highly concentrated, the uptake of environmentally friendly cars is largely driven by the policy environment and whether the goal of 4.6 million electric automobiles by 2020 can be achieved is more than questionable. Japan on the other hand has the biggest HEV market worldwide and holds almost 7% of shares in the PEV market. In 2017, it already met the targets for HEVs and fast charging stations. However, due to the slow adoption rate of PEVs and the slow expansion of the total public charging network, some deployment targets remain a big challenge.

Key Terms

- Battery electric vehicle (BEV): Runs exclusively on electricity via on-board batteries that are charged by plugging into an outlet or charging station.

- Hybrid electric vehicle (HEV): A vehicle that uses both an electric motor and a gasoline engine to power the vehicle.

- Plug-in electric vehicle (PEV): Is a subset of electric vehicles that includes battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs).

- Plug-in hybrid electric vehicle (PHEV): A hybrid vehicle that is capable of storing energy from the power grid in the on-board batteries.