Volatile Growth Market Amid Evolving Challenges

Risks are part and parcel of everyday life in an interwoven world. Thus, risk identification always serves a vital role to safeguard the business as much as possible. As a responsible top international insurer, Allianz conducts an annual global risk identification research study to share insights on potential risks and help improve effectiveness of risk control.

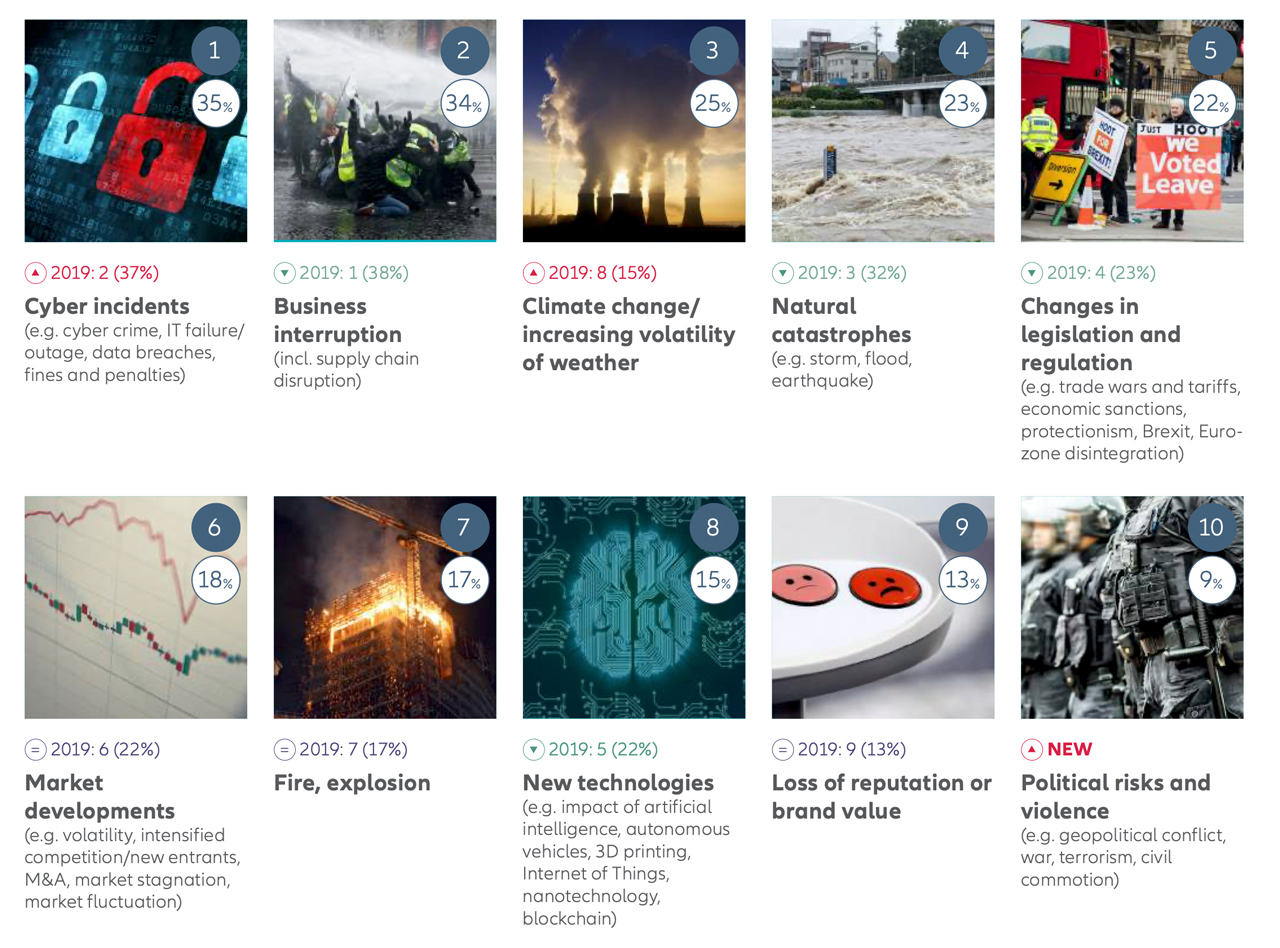

The 2020 Allianz Risk Barometer is the largest today, incorporating the views of a record of up to three thousand respondents from 102 countries and territories, among which 760 respondents come from 10 markets in Asia Pacific. Risk experts from large and small and medium-sized enterprises across 22 industry sectors were questioned during October and November 2019. The report identified the top risks world- wide including cyber incidents, business interruption, changes in legislation and regulation, as well as other high-profile risks. The top 10 risks in Asia Pacific, that the Allianz Risk Barometer 2020 identified, includes cyber incidents, business interruption, climate change, and other high potential risks which are shown below with the corresponding percentage of responses.

Increasing awareness of cyber risks

Cyber incidents ranked top in Asia for the first time ever, relegating the perennial top risk Business interruption (BI) to second place. A significant result that reflects a global trend of increasing awareness of cyber threats in recent years, driven by companies' increasing reliance on data, IT systems and a number of high-profile incidents that include e.g. cyber crime, IT failure/outage, data breaches, fines and penalties.

Cyber risks were not even ranked in the top 10 risks for Asia Pacific before 2015, yet continues to evolve rapidly throughout the years. A significant increase in the number of ransomware incidents is helping to drive up the frequency of losses for companies. Overall, cyber attacks are becoming more sophisticated and targeted as criminals seek higher rewards with multimillion-dollar extortion demands. Allianz Global Corporate & Specialty (AGCS) estimates that the costs of a cyber incident are rising across the board, a product of growing complexity, more stringent regulation and the damaging consequences to a business from a loss of data or critical systems. In particular, the cost of large data breaches continues to increase, as data protection and privacy regulation widen in scope and geographical reach and class action litigation also starts to impact the cost of dealing with a breach. Meanwhile, when an incident leads to significant business interruption, losses are typically high. The main causes of a cyber incident are identified as data security breach, espionage, hacker attack, ransomware, denial of service as well as errors by employees. It is estimated that anywhere between 50% and 90% of breaches are caused or abetted by employees, be it by simple error or by falling victim of phishing or social engineering. Well-trained and vigilant employees can become an extension of a company’s cyber security team and help form a much firmer perimeter around the company’s assets.

Business interruption risks continues unabated

After seven years at the top, Business interruption (BI) drops to the second position in the Allianz Risk Barometer in Asia. However, the trend for larger and more complex BI losses continues unabated. Causes are becoming ever more diverse, ranging from fire, explosion or natural catastrophes to digital supply chains or even political violence. According to AGCS, fire and explosion incidents are the most frequent cause of business interruption loss, accounting for almost a third (30%) of claims by number. BI costs following a fire can significantly add to the final loss total. Businesses are also increasingly exposed to the direct or indirect impact of riots, civil unrest or terrorism. Escalating civil unrest in Hong Kong, for instance, has resulted in property damage, BI and general loss of income for both local and multinational companies. The consequence is a business interruption without physical losses but high financial ones. This ongoing social unrest has resulted in a 40% year-on-year drop in tourism with serious ramifications for the industry. AGCS also pointed out that another consequence of these types of events is that employees might not be able to access their workplace because of security reasons, which can reduce productivity or bring production to a standstill in other industries. At a time when many industries and supply chains are becoming more sensitive to BI, shareholders and customers are also becoming more risk averse and less forgiving of surprises. As a result, large companies are increasingly looking to protect their balance sheets with more tailored BI solutions.

Huge rise of climate change risks

Climate change is a huge riser regionally, jumping to third from eighth position last year, driven by risk management experts in countries and territories such as Hong Kong, India and Indonesia. It reflects the fact that its impact can trigger huge and unpredictable loss scenarios for business alike and therefore should be at the core of all mitigation and resilience actions. The growing cost of climate change is already noticeable. Analysis show that the number of weather-related/flood loss events has increased by a factor of three to four since 1980. Severe floods in Jakarta in recent years have certainly hammered home the consequences of increasingly volatile weather for businesses. Four years after the United Nations’ momentous Paris Agreement – the target of which is to keep the increase in global average temperatures to well below 2°C above pre-industrial levels, and to try to limit the rise to 1.5°C – it has become clear that the progress and policies on emission reductions have, so far, been insufficient. Many industries are facing major transformation risks – and expenses – in order to ensure their future business models are more climate-friendly. Overall, Allianz has estimated that responding to the challenges posed by climate change could cost companies worldwide as much as $2.5trn over the next 10 years with the cost of making the energy sector “greener” the highest. The automotive, chemical and agriculture industries are just a few of the other sectors that will be particularly impacted. AGCS sees mainly two scenarios on how climate change affects businesses. Firstly, busi nesses face a broader range of physical loss scenarios. For example, a temperature increase of more than 2°C would expose greater parts of our world to storms and flood losses. Secondly, legal and political policies to reduce emissions are challenging industries such as automotive, transportation and utilities – they all have to transform and ‘de-carbonize’ their business models.

Declined yet unneglectable regional natural catastrophes

Devastating typhoons in Asia and record-breaking wildfires in Australia were among the disasters which dominated global headlines in 2019. Thus, natural catastrophe risks were also ranked top 4 in the 2020 Risk Barometer in Asia Pacific, while ranked even top 2 in China and Malaysia. However, economic losses from natural catastrophe events actually declined 20% year-on-year to around $133bn, according to reinsurer Swiss Re. Insured losses also fell to $50bn from $84bn, driven by Hurricane Dorian in North America ($4.5bn) and typhoons Faxai ($7bn) and Hagibis ($8bn) in Japan. In 2019, there was yet no single major natural catastrophe (nat cat) event comparable in economic loss size with those of the 2017 Atlantic hurricane season but rather the aggregated losses from multiple small to medium-sized events have led to widespread devastation and still caused considerable overall insured losses. In recent years, significant non-weather-related nat cat events, such as earthquakes or tsunamis, have been rare and, consequently, the importance of these risks has declined in the Allianz Risk Barometer overall but it remains high in regions affected more frequently.

Risks resulting from the era of change

Risk of legislation and regulation change is ranked top 5 in Asia and top 3 from a global perspective. One of the main causes was the change of trading policy. The world’s two largest economies have been locked in a bitter trade battle for over 21 months now with the US and China imposing tariffs on hundreds of billions of dollars’ worth of one another’s goods. Hopes that the US-China trade dispute would ease did not materialize in 2019. Protectionism became the new normal with around 1,300 new trade barriers implemented at unpredictable dates, thus making it difficult to plan accurately for the future. This is the reason why respondents in China have rated business interruption as a top risk in their replies. The US-China trade dispute has brought the US average tariff to 8% – close to levels last seen in the 1970s – from 3.5% at the end of 2017. At the same time, a higher share of global trade is also now being tariffed. In addition, Allianz Economic Research recently pointed out that trade policy is becoming another political tool for many different policy ends, such as economic diplomacy, geopolitical influence or environmental policy. Something also seen outside of the US in Japan and South Korea, India and the EU. To sum up, industries in Asia have been through a period of tremendous growth in the past few years, showing solid fundamentals and potentials to evolve and embrace further development. In the meantime, though, the business environment has shifted: business interruption resulting from complex causes, deterioration of the natural environment, as well as increasingly demanding regulatory and policy conditions are combining to present enterprises with significant new challenges. Corporates need to take immediate action on risk management, and risk identification is always a prerequisite that comes into play. Tackling these challenges requires focus and effort, yet despite the region facing myriad risks, growth will continue to find a way in Asia.

Abstract on COVID-19:

Even though more and more countries have resumed from lockdowns and also temporary border controls are being lifted across Europe, the coronavirus pandemic is far from over. Opinions are divided on when the threat will pass, when we can return to normalcy and what the new normal would be. But with COVID-19 impacting economies, businesses and the health of millions of people worldwide, countries will most likely have to deal with this unprecedented crisis for a long time. Weeks and months of disruptions in supply chains, the temporary closure of shops and the effects of partial lockdowns are creating a negative economic downturn. These unseen changes attest the systematic impact of a pandemic to the interconnected world. Although the Allianz Risk Barometer research was conducted before the COVID-19 outbreak, health issues was indicated in the results and ranked on 13th place in Asia Pacific, with 7% of the responses. In addition, health issues made it to the top 10 for the first time in China, Malaysia and Philippines, suggesting that it could be a rising risk going forward but a pandemic remains difficult to predict – also for an insurer. The coronavirus crisis will most likely change the evaluation of risks going forward.