The Indian National Health Protection Scheme – Opportunities and Challenges

The National Health Protection Scheme or the Pradhan Mantri Jan Arogya Yojana, as it is popularly known, was one year old on September 23, 2019. This government-funded scheme is India’s most ambitious healthcare initiative to date and was announced as part of the larger initiative called ‘Ayushman Bharat’, which roughly translates to ‘Healthy India’. In the following article, Nexdigm (SKP) will take a closer look at the scheme.

Ayushman Bharat (AB) aims to establish a Continuum of Care across the country using two sub-levels – the National Health Protection Scheme (NHPS) and Health and Wellness Centers (HWCs). It provides a holistic, needsbased healthcare ecosystem, evolving from India’s previous, segmented approach in healthcare. The program is a pioneer towards preventive and ambulatory care (at all levels of healthcare delivery) in India. The NHPS offers health insurance of ~€6,250 per family per year to 500 million beneficiaries (covering only secondary and tertiary care hospitalization). A beneficiary can visit any impaneled hospital across the country for procedures approved under the scheme. Currently, approximately 1500+ interventions/procedures are permitted under the NHPS. The entire process is cashless and hence, very patient-friendly. Beneficiaries are chosen according to data from the Socio-Economic Caste Census of 2011. The scheme is completely government-funded. India follows a federal governance structure, and since health is a state subject, the cost of implementation is shared between the central and state governments. The other aim of the AB initiative is to create 150,000 Health and Wellness Centers by transforming the existing network of sub-centers and Primary Healthcare Centers (PHCs). HWCs provides comprehensive primary healthcare services, covering maternal health, infectious diseases, and Non-Communicable Diseases (NCDs) through free diagnostic services and medicines. HWCs are expected to act as a gatekeeper towards establishing a robust referral system which would reduce the burden on secondary and tertiary care centers. These centers would also facilitate preventive-care awareness among the rural population. Within the last year, India’s National Health Authority (NHA), the apex body responsible for implementing AB, has signed on 32 states and union territories to implement the scheme. In the last year, the NHA has issued 100 million e-cards, and enabled 4.6 million treatments in 18,236 impaneled hospitals, with an expenditure of over USD 1.1 billion.

The Opportunity

AB addresses three ‘A’s lagging in the Indian healthcare ecosystem – Accessibility, Affordability, and Availability. It extends health insurance to almost 40 % of the population, with additional positive ripple effects expected for the middle-income population.

AB introduces two fundamental changes to the healthcare system

- Changing the role of the government from “Provider to Payer” and

- Setting India on an irreversible path towards Universal Healthcare Coverage (UHC).

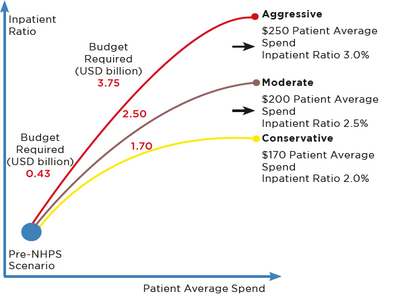

While the impact of NHPS will certainly be substantial, its magnitude will vary for different industry segments. The impact will be recurring for some segments, and for others, it may not be as pronounced. NHPS should create a large influx of new patients into the healthcare ecosystem, driven by increasing awareness and insurance coverage. While health insurance penetration in India has been historically low, it has doubled in the last five years, increasing from 17% to almost 35%. With NHPS, insurance penetration is expected to rise to almost 60% in the country. A softer but equally significant benefit is a change in mindset from curative care to preventive care. In the initial months post-launch, 6,000 to 7,000 patients were treated per day, across 15,000 hospitals, with the average spend per patient of ~USD 170, hence benefiting ~2.5 million patients annually. The NHA believes that these numbers will increase significantly to ~30,000 patients per day, stabilizing to ~10 million patients annually. When it stabilizes, the average spend per patient is expected to increase from USD 170 to USD 200. This would increase the budgetary requirement from the current USD 1.7 billion to ~USD 2.5 billion, with inpatient ratios rising from the current 2% to 2.5%, respectively. The figure above shows these estimates in three possible scenarios.

Healthcare delivery sector

This sector would be the biggest beneficiary as the new influx of patients will require additional capacity in hospitals/ beds to be created. In addition to improved capacity utilization of existing facilities, significant new investments into additional capacity building are expected. Since the scheme covers the underserved populations, much of this additional capacity is needed in lower-tier cities/towns to enable easy access to patients. This would balance the currently skewed bed-to-population ratio and the urban-rural divide in terms healthcare service availability. The healthcare delivery segment can benefit from economies of scale due to the larger patient influx. The delivery segment has a multiplier effect on other areas of the healthcare industry, like the demand for a skilled workforce, a need for medical devices and equipment, and various ancillary services.

Medical Devices

Historically, the per capita spending on medical devices in India has been low. While China spends ~USD 13 and the USA spends ~USD 340 on medical devices per capita, India only spends around ~USD 3. With NHPS, this number is expected to increase significantly over the next couple of years. The increased patient pool and capacity building of healthcare delivery will favorably impact the medical equipment and devices industry. We expect an increase in demand and growth across medical equipment, diagnostics, implants, consumables and disposables, and ancillary products. India is uniquely disadvantaged with a dual disease burden of communicable and non-communicable disease. With a large section of the rural and semi-urban populations coming under the ambit of insurance, numerous therapies and treatments will see an immediate impact. We expect therapeutic areas like cardiology, oncology, dialysis, and ophthalmology to see increased demand early, increasing the demand for medical devices in these areas. Medical technology companies could review their product portfolios and develop products designed to meet the increased demand at appropriate price points. These may need redesign and value engineering to develop cost-effective product options that better serve the NHPS patients. Companies that are able to do this successfully could be better placed to enhance market shares in this expanding opportunity.

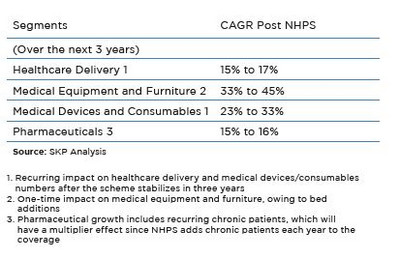

The table below summarizes the overall growth estimates for the healthcare industry over the next three years. This is further elucidated in SKP’s whitepaper assessing the market impact of NHPS.

With NHPS creating a surge in demand for healthcare services, there would be significant pressure on the supply side. This could strain the existing infrastructure until sufficient capacity is built up. Ramping up capacity to the level needed would require India to address major gaps in the availability of various categories of skilled workforce in medical and allied or ancillary disciplines. Adequate funding to pay for these services needs to be ensured. Such capacity-building needs to be done without compromising on the quality of care and patient outcomes. These are significant challenges, particularly in a resource-constrained economy like India. Hence, all stakeholders need to rally together to work towards the goal of UHC. NHPS, if implemented well, has the potential to transform the Indian healthcare landscape. Improving healthcare for India’s citizens would result in a significant domino effect on the productivity, competitiveness, and the socio-economic development of the country. For more insights into the opportunities in the Indian healthcare space, please refer to Nexdigm (SKP)’s whitepaper on ‘India’s National Health Protection Scheme’.